All Solutions

Explore all the solutions you can create with Paperform: surveys, quizzes, tests, payment forms, scheduling forms, and a whole lot more.

See all solutions

Connect with over 2,000 popular apps and software to improve productivity and automate workflows

See all integrationsProducts

Solutions

All Solutions

Explore all the solutions you can create with Paperform: surveys, quizzes, tests, payment forms, scheduling forms, and a whole lot more.

See all solutionsIntegrations

Connect with over 2,000 popular apps and software to improve productivity and automate workflows

See all integrationsResources

The 7 Best PayPal Alternatives in 2023

Back in the day, if you wanted to send somebody money, you either mailed them a check or a money order or probably offered cash. But you were out of luck if you wanted to send them money digitally or over the Internet—it was unheard of.

Also, collecting money from someone's checking account or credit card was complex, expensive, and involved a difficult-to-learn point-of-sale system.

PayPal changed all that! It enabled their servers to access your banking and credit accounts and money transfers. At the time, it was revolutionary for independent sellers and small businesses.

Over time, PayPal has grown and evolved as a business tool. It fills a niche that it created and has stayed on top. There is no exact one-to-one alternative, but it comes with some limitations.

So let's look at a few PayPal alternatives you can use in 2023.

The best PayPal alternatives in 2023

For Personal Transactions

The main thing that PayPal does is let you transfer funds from person to person. So let’s look at apps that do that first.

1. Cash App

(Source: Cash App)

(Source: Cash App)Cash App is a digital wallet/cash card with superpowers. It can safely and efficiently transfer money to other Cash App users. And it has quite a few more features, like these:

- Lightweight Banking: If your finances are simple, you can use Cash App to replace your traditional banking institution. You won’t get a chequebook, but you won’t get any overdraft fees. You don't have to give up your current bank, however. You can transfer money between Cash App and your existing bank account.

- Bitcoin Trading: If investing in the world's most volatile market is your thing, Cash App will let you trade in Bitcoin.

- Stock Trading: If you’re looking for investment opportunities, Cash App lets you invest in traditional stocks minus the commission fee.

- Debit Card: Continuing with the theme of being a bank replacement, Cash App provides a Visa-branded debit card for free. You can customise it with your design, images, and colours.

- Check and Cash Deposit: The cash App wants to make getting money into your account as easy as possible. And since it offers routing and account numbers, direct deposit is possible.

- Boosts: Boosts are ongoing discounts you can apply to your Cash App card to save money where you shop most. You can only use one boost at a time, but switching between them is easy.

- Taxes: Cash App will also let you do your state and federal taxes from your phone for free.

- Round Ups: A handful of savings accounts work by rounding up every purchase to the nearest dollar and adding the extra pennies to a savings account. Cash App is one of them. What's more, you can have that extra money automatically invested.

2. Skrill

(Source: Skrill)

(Source: Skrill)Skrill is a virtual wallet similar to Cash App but without as many bells and whistles, although it does let you send money internationally. Here are some of its features:

- Send money to non-Skrill users: All you need is a phone number or email address to send money; if they want to collect, they'll just have to sign up!

- Debit Card: Even though Skrill isn't a banking alternative, they still hold your money and have a Visa-branded debit card.

- Sports and Gambling Focus: Because Skrill doesn't have much to offer, they needed some way to stand out. So they chose to focus on sports and gambling. They even give you sports tips, stats, and news. So if you're putting some money on the next big game, Skrill wants you to keep them in mind.

- Rewards Program: Another nice feature that Skrill offers is its rewards program. You gain points every time you spend money with Skrill. Then you can use those points to buy rewards.

3. Venmo

(Source: Venmo)

(Source: Venmo)PayPal established itself before smartphones were even a thing. For that reason, sharing money with PayPal can feel clunky for people used to streamlined mobile apps.

Venmo makes sharing money through mobile payments smooth and easy. You can access someone's account name by scanning a barcode on their phone and sending the cash in minutes.

Another thing that makes Venmo stand out from the crowd is that it has a social media vibe. You can see online transactions that your friends have made, to whom, and for what.

Venmo got in early and made a big name for themselves, so they don’t need to pad their offering with many features. But they do have a few, like these:

- Debit Card: Like the others, Venmo doesn't transfer money directly from one bank account to another. That means they need to hold some money for you. So, like the others, Venmo works like a cash card and offers a MasterCard-branded debit card.

- Credit Card: If you're looking for creative and unique places to get a credit card, you're in luck. Venmo offers one. It works seamlessly with the Venmo service. And while sending money with most credit cards will cost you 3%, you can send money for free with the Venmo card.

- Crypto Trading: Just like Cash App, Venmo allows you to buy and sell Bitcoin. But they go a little bit further. They provide educational materials to help you learn about the field and be aware of its pitfalls.

4. Zelle

(Source: Zelle)

(Source: Zelle)Zelle is the barest of bare-bones ways to send money. Unlike the previous products mentioned, Zelle doesn't hold funds. They work with a system American banks use to transfer money, called ACH (Automated Clearing House).

The Automated Clearing House system usually takes two or three business days to transfer money between banks. Zelle offers the advantage of letting you do that instantly instead.

Zelle is a bank transfer tool, and that’s it. Here is a complete list of Zelle’s added features:

- You use it to send money. That’s all.

Zelle has a couple of drawbacks that are part of its simple way of doing business.

- Transfer quantity limited by your bank: Every bank has its policies and procedures. Because Zelle doesn't hold any money for you, they rely on your bank to determine the maximum size of payments, and you'll have to check with your bank to determine what can be sent.

- You can send money to the wrong person: It doesn't happen as much anymore with cell phones, but back in the day, dialling the wrong number was part of the landline experience. It happened all the time. Zelle brings back all the nostalgia of dialling the wrong number but with the added joy of potentially losing hundreds of dollars in the process. Always triple-check to make sure you know where your money is going!

- No Fraud Protection: If you pay the wrong person either as a mistake or as part of a scam, you have no recourse to get your money back. So, always think twice.

- Only works with US banks: Since Zelle relies on an American banking transfer protocol, you can only send money to other American banks. It also means you can't send money from a credit card.

In essence, Zelle is a great option for simplicity. But you do need to keep your head on your shoulders. Think about every online transaction you make before you hit send. And treat your transactions as if they were cash. Once you give it away, you're not getting it back.

For business transactions

Whether you’re running your own ecommerce business, collecting client payments, or performing other credit card transactions, you need a professional way to accept money. These solutions offer more than basic person-to-person transactions and include features required by business owners.

5. Payoneer

(Source: Payoneer)

(Source: Payoneer)One huge selling factor of PayPal is its global reach. You can send money through PayPal to almost anybody in the world. Many PayPal alternatives have little or no international transfer support. Payoneer is an exception to that rule.

Payoneer offers business-oriented financial solutions for small to medium companies that want to market to a global audience. Here are some of the benefits they provide:

- International Contractor Payment: Payoneer lets you sell products in other countries, but the international payment advantage goes even further. If you're a freelancer with clients in other countries or a firm working with freelancers or contractors in other countries, Payoneer makes exchanging money with any of them possible.

- Local accounts: Payoneer lets you open accounts in multiple countries, making transactions with people in those countries easier using local currency.

- Currency Conversions: Payoneer lets you exchange currencies within their system, so you can avoid transferring money back and forth when you need a different currency.

- Capital Advances: Payoneer offers small capital advances for small to medium businesses to help them get a leg up. And if you are a retailer selling on Amazon or Walmart, you can get a significantly larger advance.

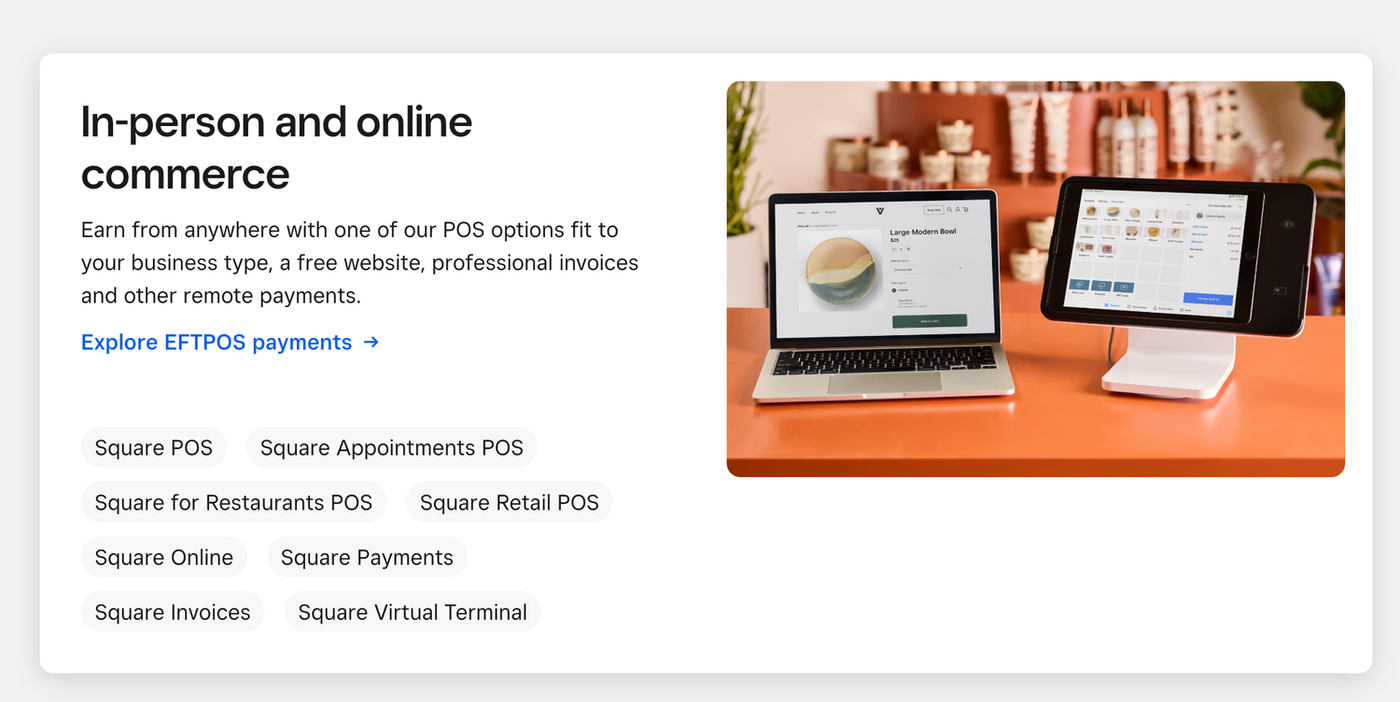

6. Square

(Source: Square)

(Source: Square)Square made revolutionary changes in how small business gets done.

Several years ago, Square came out with a fantastic gadget. It's a credit card swiper that you can plug into the headphone jack of your cell. It lets plumbers, pool cleaners, closet organisers, and other independent contractors accept money from clients on-site as if they were a member of a much larger outfit.

Square also created a line of point-of-sale systems that are affordable, contract-free, and easy to start. They let small boutiques and hipster coffee shops throw off the tyranny of soul-crushing POS systems.

Square offers a massive host of services for businesses. And each one has many features. Let’s touch on a few of the most prominent services they offer:

- Banking: In line with Square's promise to help people with all things business, they offer fee-free business checking, savings, and loans. You don't need an EIN to create a checking account with Square, but it is encouraged.

- Staff: Square also offers several tools to help you manage your staff and employees. That includes scheduling, payroll, benefits, and more.

- Online and Offline Store: Whether you are selling online or offline, Square can help your business process any kind of payment quickly.

- Appointments, Invoices, and Customer Management: If you're a freelancer or independent contractor, Square offers many services to help you easily manage your business admin and customer success.

7. Stripe

(Source: Stripe)

(Source: Stripe)Stripe started as a way for internet startups to collect funds. Over time, Stripe became a significant offering for all online businesses.

Like Square disrupted the world of retail sales, Stripe disrupted the world of online sales. Traditional payment gateway services are hard to work with, even for online payments. They have long contracts, high transaction and merchant fees, and are rarely programmer friendly.

Stripe lets any decent programmer add payment collection to a web app in a few hours. Stripe makes sure that collection is safe, trustworthy, and PCI compliant. That means that programmers only have to focus on the code.

Because Stripe is so programmer oriented, it spread like wildfire in the world of SaaS applications. Almost whenever you spend money online, Stripe acts as the credit card payment gateway behind the scenes. Even Amazon started working with Stripe to expand its international payment reach.

Some of the benefits of using Stripe include:

- International Transactions: As was mentioned, their partnership with Amazon was created to help Amazon spread into international territory. That's because Stripe is globally available in 46 countries.

- A massive suite of tightly integrated financial tools: Anything your business needs to do can be done with Stripe.

- Wide Adoption: If you want to accept money online and plan on having something other than your own shop or even much of an internet presence, whatever tools you choose will probably use Stripe behind the scenes. As long as you have a Stripe account, you can connect it just about anywhere.

- Developer Friendly: Stripe hasn't lost touch with its roots. They are still just as programmer-focused as ever. And even though the complexity of their offering has significantly expanded, they still make it easy to get your web app up, running and accepting secure payments in no time.

Collect payments securely with Paperform

As mentioned in the previous section about Stripe, the fact that it's so widely adopted means you can use it from anywhere. If you're a freelancer, artist, or selling a few items online but don't want to avoid the hassle of setting up a whole shop, what's the best option?

You obviously need to have a professional presence on the Internet if you're going to be accepting money from people. You need a tool that's powerful, meets many of your business needs, and looks crisp and clean with a professional finish.

The quickest and easiest way to get to that point is by using Paperform. Paperform is, as its name implies, a form tool. You can use Paperform to set up simple and trustworthy online digital payment forms that perfectly match your company's brand.

And because Paperform is so flexible, the solution you come up with will be uniquely yours and match your needs perfectly.

Even better, Paperform integrates with over 20+ payment processing platforms, including PayPal, Stripe, and Square. If you only want to transfer money, connect Paperform to PayPal and Stripe and let your customers/clients decide which platform works best for them.

Or you can integrate it with your Square shop and collect money from other places outside your shop by adding your custom payment form anywhere on the web.

So why not get the ball rolling? Try Paperform free today, no credit card required, and start collecting insights today.

Related reading

- What is branded dropshipping and how do you get started?

- Stripe vs. Square vs. PayPal: which payment processor is best?

- The 10 best Gumroad alternatives in 2023

- The 8 Best Shopify Alternatives in 2023

- Etsy alternatives: The best sites for handmade crafts

Freelance Contributor

Form a better life now.

Get your 7 day unrestricted trialWhen Kathleen Celmins launched her AI-powered app, GlowSocial, she quickly realized that building cu...

Paperform has been recognized as a 2026 G2 Best Software Award winner! It is an honour we are deeply...

This article will help you untangle the web of very “samey” WordPress form builder plugins.

Trying to decide between Zapier and Stepper? This in-depth comparison breaks down pricing models, wo...